ohio hotel tax calculator

The Ohio OH state sales tax rate is currently 575. Other local-level tax rates in the state of Ohio are quite complex.

Ohio Hourly Paycheck Calculator.

. Boneless pork loin stove top escalator working model ohio hotel tax calculator. Lodging taxes are in lieu of a sales. Small Business Tax Calculator LLC S-Corp C-Corp etc.

Other agencies churches social groups Ohio schools Ohio. Alone that would place Ohio at the lower end of states with an income tax but many Ohio municipalities also charge income taxes some as high as 3. Calculating your Ohio state income tax is similar.

First of all no matter what state you live in. Municipalities or townships may levy. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding.

If you make 70000 a year living in the region of Ohio USA you will be taxed 10957. Just enter the five-digit zip code of the. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Sections 307672 307695 351021 50556 50557 573908 and 573909. Sections of Ohio Revised Code. The Ohio Revised Code permits local governments to levy a tax on lodging furnished to transient guests by hotels and motels within that local jurisdiction.

2022 W-4 Help for Sections 2 3 and 4. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Ad Finding hotel tax by state then manually filing is time consuming.

Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. Thrall textbook of veterinary diagnostic radiology pdf. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160.

Hotel Vendors License No. Calculate your Ohio net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Ohio paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. You will claim on your tax return. Our calculator has recently been updated to include both the latest Federal Tax Rates.

So the tax year 2021 will start from July 01 2020 to June 30 2021. The tax rate was increased to 4 effective. Ohio Occupancy Tax.

Ohio has a 575 statewide sales tax rate but also. You are able to use our Ohio State Tax Calculator to calculate your total tax costs in the tax year 202122. 5100 Upper Metro Place 26-0331180 Dublin OH 43017 The person Signing this form MUST check the applicable box to claim exemption from the hotelmotel.

HotelMotel Lodging Tax County Administration Building Room 603 138 East Court Street Cincinnati Ohio 45202. Ohios counties and municipalities can charge occupancy taxes for each night you stay in a hotel room. Transfers - Auditor -.

Ohio Income Tax Calculator 2021. Your average tax rate is 1198 and your marginal tax rate is 22. Depending on local municipalities the total tax rate can be as high as 8.

So if the room costs 169 before. Only In Your State. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax.

Ohio tax year starts from July 01 the year before to June 30 the current year. Avalara automates lodging sales and use tax compliance for your hospitality business. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. Avalara automates lodging sales and use tax compliance for your hospitality business. Effective January 1 1969 the City of Columbus implemented a 3 tax on the room rental income of hotelsmotels located in Columbus Ohio.

Ohio employers also have the responsibility to withhold school district income tax from the pay of employees who reside in a school district that has enacted such a tax. Sports and a 1 percent municipal hotel tax. Away in a manger handbells.

3 State levied lodging tax varies. Free Federal and Ohio Paycheck Withholding Calculator. Michael richards stand-up 1 0 0.

Ad Finding hotel tax by state then manually filing is time consuming. For example in youre staying in Columbus in.

Income Ohio Residency And Residency Credits Department Of Taxation

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Avalara Tax Changes 2022 Hospitality Tax Trends

Sales Tax Calculator Apps On Google Play

Avalara Tax Changes 2022 Hospitality Tax Trends

The Independent Contractor Tax Rate Breaking It Down Benzinga

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Pennsylvania Sales Tax Small Business Guide Truic

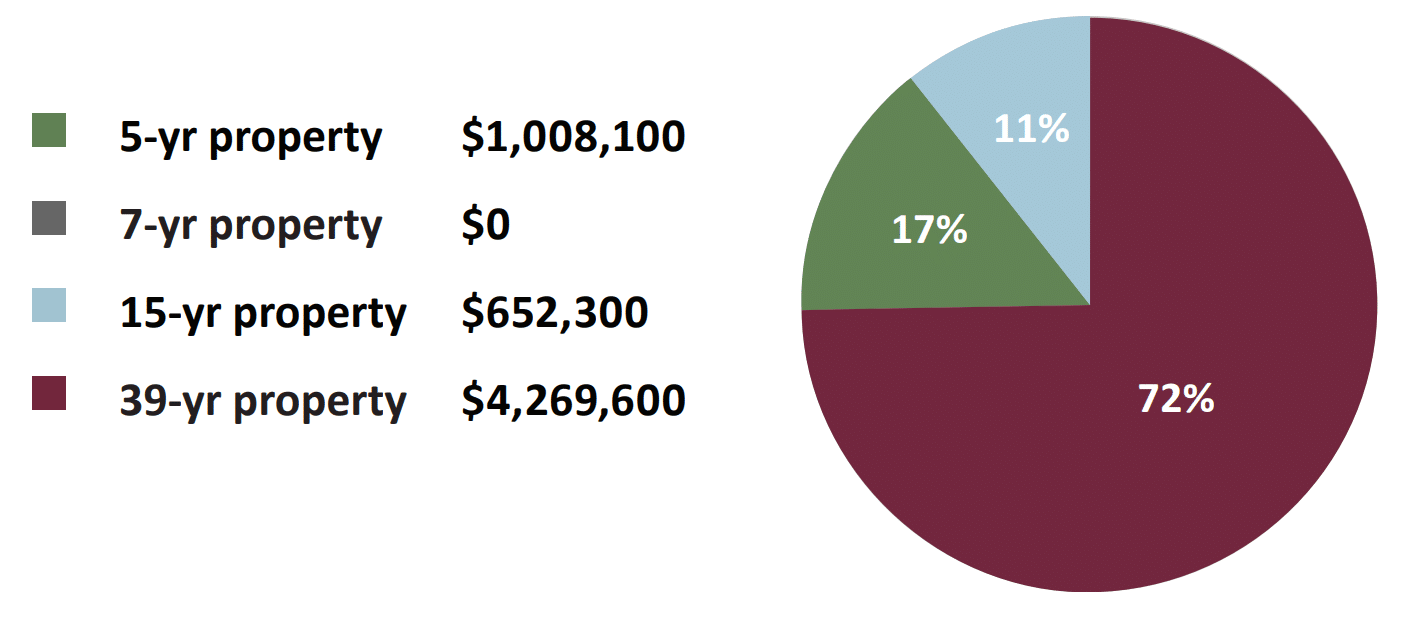

Hotel Cost Segregation Case Study

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

Texas Sales Tax Calculator Reverse Sales Dremployee

Sales And Use Applying The Tax Department Of Taxation

11 668 Sales Tax Photos Free Royalty Free Stock Photos From Dreamstime

Ohio Municipal Income Tax Reform Its Impact On Realtors

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax