capital gains tax increase canada

Of the total 546 percent was declared by taxpayers with incomes over 250000. If a change to the capital gain inclusion rate is announced.

Capital Gains Tax What Is It When Do You Pay It

The tax rate has remained unchanged since 2000 and is now the 14th-highest among the 34 countries that were members of the Organization for Economic Co-operation and Development in 2013 according to the Fraser Institute in its report Economic cost of capital gains tax in Canada.

. More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000. For now the inclusion rate is 50. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

In all Canadians realized 729 billion in taxable capital gains. This means that only half of your capital gains will be taxed by the CRA. The capital gains tax rate in Ontario for the highest income bracket is 2676.

No discussion of personal tax changes would be complete without the annual warning about a potential increase in the capital gains inclusion rate. But if were talking about a 25 increase in the capital gains tax Id say sell now while you have the chance. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years.

Capital gains tax on home sales a risky proposal experts say by brett bundale the canadian press posted september 10 2021 514 pm. The Chrétien and Martin Liberals reduced the capital gains inclusion rate the amount of capital gains subject to tax from 75 to 50 as part of a larger initiative to improve Canadas competitiveness and attractiveness to investors. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

How are capital gains calculated. Real estate capital gains tax should be non-starter - Toronto Sun and find out a lot of new information with us. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large corporations.

You would pay the marginal tax rate on the 50 capital gain in this case 25. Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues. Fiscal cost of partial inclusion of capital gains.

This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the next federal budget. In Canada the capital gains inclusion rate is 50. This means that.

So if you have realized capital gains of 200 you will get to. There has been some desire from federal parties to increase the capital gains inclusion rate to 75 or higher. He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate.

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Capital gains tax proposal canada. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. The Green Book specifically provides for a retroactive effective date for the capital gains tax increase. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues.

So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital gain amount is 50. The capital gains tax is the same for everyone in Canada currently 50. If this were to happen the benefit of earning capital gains instead of income would be reduced.

And the tax rate depends on your income. It wasnt in the Liberal election platform but given the NDPs playbook had a hike in the capital gains inclusion rate to 75 per cent some worry the NDP may hold. A capital gains tax increase would be a form of annual wealth tax that would be.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada. Pin On Semiotics October 2019. Pay the 50 on your gains then reinvest your money in.

2 days agoCapital gains inclusion rate. Canada News Media provides the latest news from Canada. More information on the site.

After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on 100 per cent of her capital gains. The capital gains inclusion rate refers to how much of a capital gain is taxable. The taxes in Canada are calculated based on two critical variables.

For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be noted that capital gains are subject to the same top marginal rate of 5353 as income but given that only 50 of a capital gain is taxable it is common shorthand to refer to capital gains as. Fear of an increase in the capital gains tax has been among the. Although the concept of capital gains tax is not new to canadians there have been.

Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. It was then increased to 6667 per cent in. When the tax was first introduced to Canada the inclusion rate was 50.

In our example you would have to include 1325 2650 x 50.

How Capital Gains Affect Your Taxes H R Block

Capital Gains Tax In Canada Explained Youtube

Benefits Of Incorporating Business Law Small Business Deductions Business

Capital Gains Definition 2021 Tax Rates And Examples

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Yield Cgy Formula Calculation Example And Guide

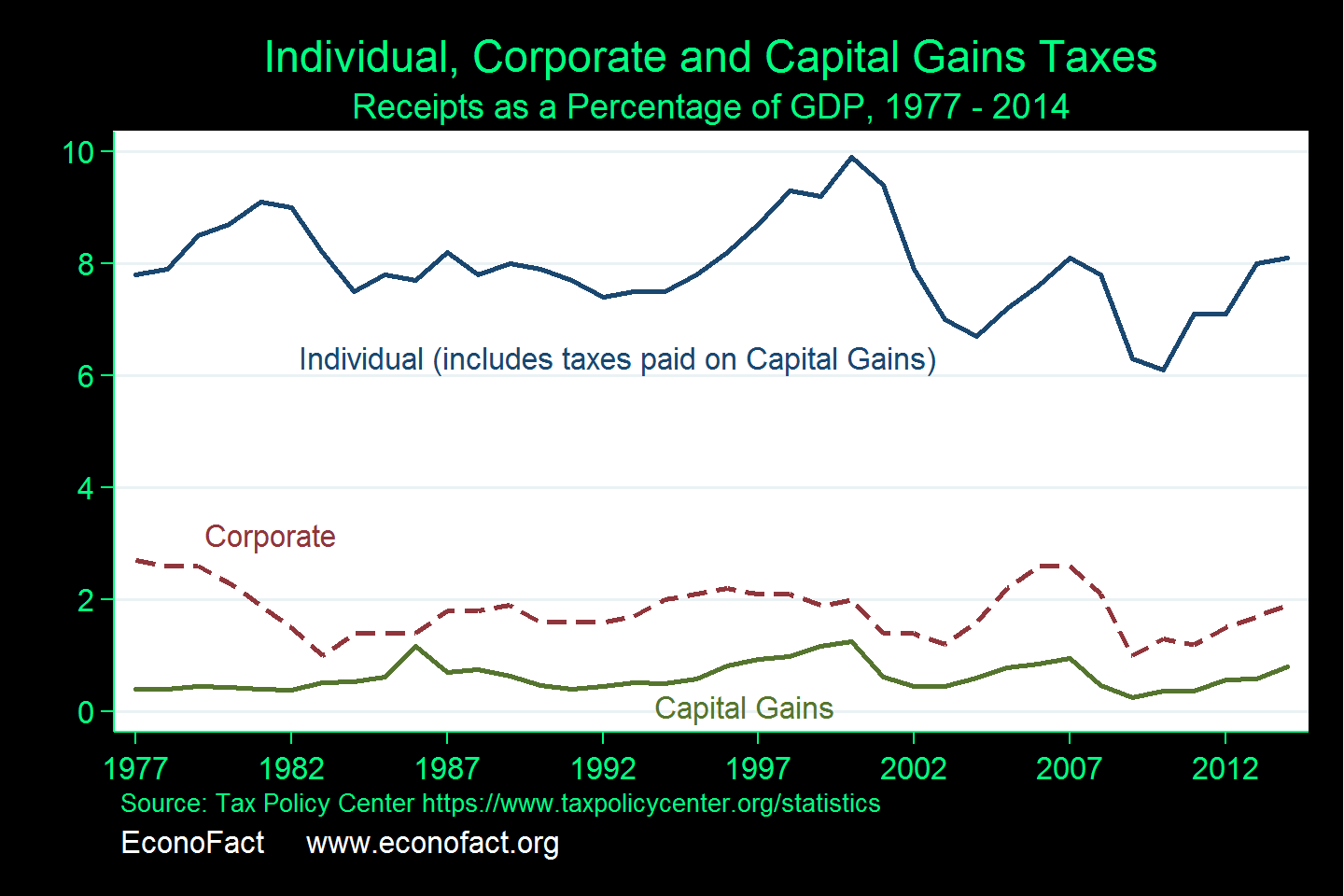

The Capital Gains Tax And Inflation Econofact

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Get Ready For 178 Billion Of Selling Ahead Of The Capital Gains Tax Hike These Are The Stocks Most At Risk Marketwatch Capital Gains Tax Capital Gain Tax

The Worker Tax Penalty If We Tax What We Want Less Of Then It Would Appear That We Want People To Stop Working And Reti Capital Gains Tax Worker Payroll Taxes

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Capital Gain Integrity

Bitcoin Snaps The Uptrend Momentum In Fall Below 50 000 What Is The Chart Saying Bitcoin Capital Gains Tax Sayings

Capital Gains Tax Brackets 2021 What They Are And Rates Capital Gains Tax Tax Brackets Capital Gain