south san francisco sales tax increase

The San Francisco Tourism Improvement District sales tax has been changed within the last year. City of San Bruno.

Critics Say Pritzker S Gas Tax Freeze Would Save Motorists Only Pennies And Hinder Efforts To Repair Deteriorating Roads Bridges In 2022 Gas Tax Motorist Repair

City of Los Gatos.

. Ad Lookup Sales Tax Rates For Free. The December 2020 total local sales tax. The South San Francisco sales.

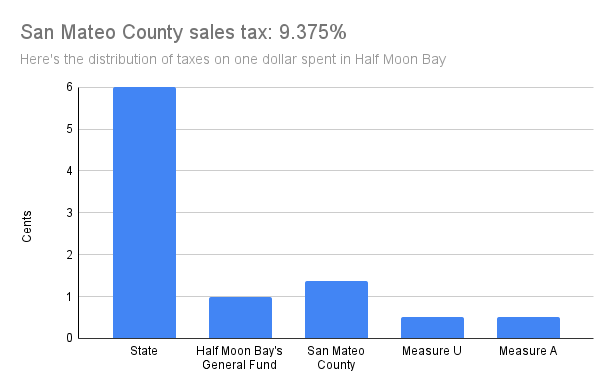

Tax returns are required monthly for all hotels and motels operating in the city. In San Francisco the sale of Levis Plaza for an estimated price of 820 million added 400 million to the roll and the newly opened Chase Center home of the Golden State Warriors added 350. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021.

Under Measure O hotel guests also have to pay a 10 tax on what they are charged for parking their vehicles at hotel parking structures. Interactive Tax Map Unlimited Use. MuniServices and City staff will look for.

10300 2075 per employeeowner Distributor Other Services. Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent. Sales tax total amount of sale x sales tax rate in this case 85.

Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. It was raised. South El Monte 10250.

CA Sales Tax Rate. The County sales tax rate is 025. As a new half-cent sales tax is set to soon go into effect in South San Francisco officials are further developing a plan for spending the revenue.

City of South San Francisco. San Francisco CA Sales Tax Rate. A sales tax measure was on the ballot for South San Francisco voters in San Mateo County California on November 3 2015.

Undeterred by a resounding defeat four years ago they are considering another try at convincing voters to raise the tax rate. City of San Mateo. San Francisco East Bay South Bay Peninsula North.

Santa Clara County This rate applies in all unincorporated areas and in incorporated cities that do not impose a district tax 952. This is the total of state county and city sales tax rates. 4 rows South San Francisco CA Sales Tax Rate.

The increase falls below the citys average increase rate of 35 over the last 10. The BCP is not limited to recovering sales and use tax revenues. Measure O increased the City of South San Franciscos hotel tax from 9 to 10.

Commercial rates are also set to increase by 2 this year. The current Transient Occupancy Tax rate is 14. The measure was designed to transfer the sales tax revenue amounting to about 7 million per year into the citys general fund to be used for.

The sales tax will go up into the double digits on Wednesday in five Bay Area cities. While a healthy increase of 123 reflective of the citys strong economy it was a slight softening versus prior years increase of 174 said the report. Allocation of Use Tax on Schedule F or Schedule C Use Tax Direct Payment Permits adoption of Proprietary Strategies and Protocols and Business-to-Business sales moved to South San Francisco.

Or to make things even easier input the San Francisco minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need. 1788 rows South Dos Palos. The current Conference Center Tax is 250 per room night.

5 rows The South San Francisco sales tax has been changed within the last year. The California sales tax rate is currently 6. Taxes to the City of South San Francisco.

The current total local sales tax rate in San Francisco CA is 8625. Any guest who stays at a hotel or similar establishment within the city borders of South San Francisco pays the tax. CITY OF SOUTH SAN FRANCISCO BUSINESS LICENSE TAX RATES AND FEES.

Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent. The South San Francisco City Council will host a discussion Wednesday March 30 regarding the spending strategy for money generated by Measure W the half-cent sales tax approved by voters in the. The minimum combined 2022 sales tax rate for South San Francisco California is 988.

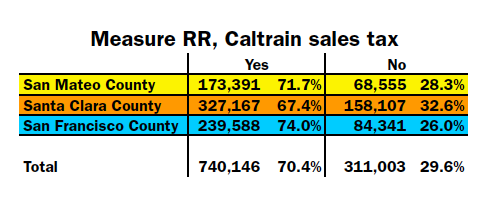

Measure W authorized the city to impose a 05 percent sales tax for 30 years. Proponents of a sales tax increase in San Mateo County never say die.

Debtrelieftips Sales Tax Debt Relief Programs Online Sales

Future Texas Real Estate Is Looking Good Sg San Francisco Real Estate The Time Is Now Expectations

7321 S South Shore Dr Unit 11e Chicago Il 60649 4 Beds 3 Baths South Shore Chicago The Unit

Car Rentals In South San Francisco From 23 Day Search For Rental Cars On Kayak

California San Francisco Business Tax Overhaul Measure Kpmg United States

Where Do Millennial Millionaires Want To Buy In Florida Of Course South Florida Real Estate Miami Skyline Innovative City

Council Post The Age Of Comfort Ultra Luxury Amenities Take Top Billing In Real Estate Luxury Amenities Real Estate Real Estate Sales

Explore South San Francisco Restaurants Hotels Things To Do

Explore South San Francisco Restaurants Hotels Things To Do

Pin On Home Buying In Massachusetts With Buyer Agents

South San Francisco Scavenger Company Garbage Disposal Recycling And Transfer Station South San Francisco Scavenger Company Garbage Disposal Recycling And Transfer Station

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Pin By The Andy Allen Team On What Does Austin Have To Offer Places To Go Places To Visit Places To See

New Caltrain Sales Tax Approved Palo Alto Daily Post